Although the Korean stock market closes in the afternoon, global markets continue to operate — and savvy investors know that the story doesn’t end with the closing bell. One powerful tool for tracking post-market sentiment and anticipating early movement in the Korean market is the KOSPI Overnight Futures. These futures, traded during U.S. hours, reflect how international forces might shape the next day’s trading in Korea. This article explains what KOSPI Overnight Futures are, how to track them in real time, and how to read them wisely.

What are KOSPI Overnight Futures

KOSPI Overnight Futures are futures contracts based on the KOSPI200 index that continue trading outside of Korea’s standard trading hours. They are primarily traded on the Chicago Mercantile Exchange (CME), aligning with U.S. market activity. From a Korean time perspective, this trading window spans from early evening into the following morning.

These futures serve as a mirror of international investor sentiment — especially those reacting to developments in the U.S. economy or major indices like the S&P 500 and NASDAQ. Because they move during global market hours, they can offer insight into how the KOSPI index might perform when the Korean market reopens the next day.

How to Monitor KOSPI Overnight Futures

Tracking KOSPI Overnight Futures (코스피 야간선물) allows investors to prepare for the next day’s market tone. Price shifts during this period can hint at early trends in the Korean market, especially when they’re driven by key events like U.S. earnings reports or global policy news.

Beyond just watching the price, investors should examine volume, momentum, and volatility to form a more complete picture. A sharp move in the futures, for example, might not hold weight without sufficient volume. Also, keep an eye on how the futures are reacting in relation to the underlying KOSPI index during regular hours — divergence between the two can reveal market hesitation or shifting sentiment.

By interpreting this data alongside broader economic context, you can better anticipate shifts and position your portfolio accordingly.

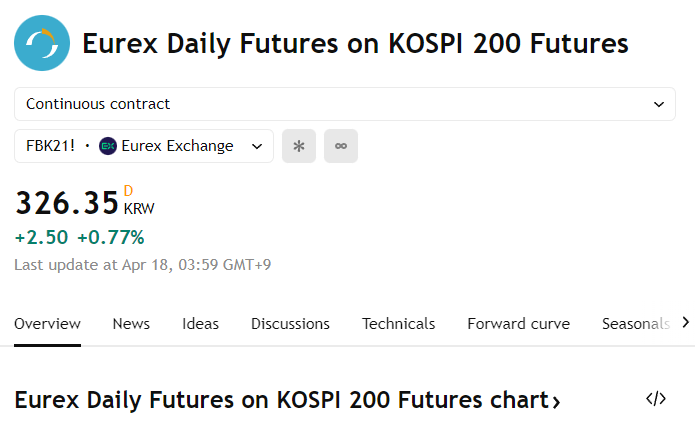

How to Check KOSPI Overnight Futures in Real Time

There are multiple reliable ways to check KOSPI Overnight Futures in real time. The most precise approach is through your brokerage firm’s HTS (Home Trading System) or MTS (Mobile Trading System). These platforms typically offer live pricing, technical charts, and market depth for futures products traded on the CME.

You can also search for (코스피 야간선물 실시간) using your preferred search engine. Financial websites often display simple widgets or charts summarizing the latest figures, making it easy to stay informed even without opening a trading app.

To react quickly to sudden movements, consider using platforms that offer alert features or push notifications. Accuracy and timeliness are essential when dealing with global markets — choose data sources you can trust.

Things to Watch When Interpreting Overnight Futures

While 코스피 야간선물 are a valuable reference, they’re not a guarantee of what’s to come. Since they respond primarily to international market events, the context behind each move is just as important as the direction.

For example, if the U.S. tech sector rallies and pushes overnight futures higher, it may signal strength in Korea’s related sectors. However, if the same movement results from one-off speculation or a geopolitical event, the implications could be more complex.

Relying on a single session’s futures data can lead to overreactions. It’s far more effective to watch ongoing trends, combine the data with other market signals like exchange rates, commodities, and foreign investor flows, and align those insights with your investment strategy.

A well-rounded view will help you treat KOSPI Overnight Futures not just as a number, but as part of a larger, dynamic picture.